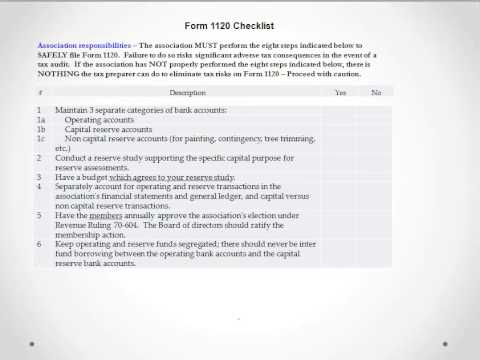

Homeowners associations that file Form 1120 need to begin their planning on the first day of the tax year. It is not something to be done a month after the year-end. It is crucial to consider various factors when filling out this tax form. One of the most important aspects is maintaining the proper types of bank accounts. While most associations already have operating and reserve accounts, it is essential to realize that the IRS views reserves differently from industry standards. The IRS categorizes capital reserve accounts separately from non-capital items. Mixing these two categories can lead to commingling operating and reserve funds, jeopardizing the safe filing of Form 1120. The second step is conducting a reserve study that supports the specific capital purposes for reserve assessments. This is a mandatory requirement under Code Section 118. The third step involves creating a budget that aligns with the reserve study, ensuring consistent allocation of funds. The reserve study should state a specific amount to set aside for reserves each month, and the budget should reflect the same amount. The fourth step requires keeping separate records of operating and reserve transactions in the association's financial statements and general ledger. Most associations usually comply with this step without any difficulties. The members of the association must annually approve the election under Revenue Ruling 7604 to file Form 1120. This election provides protection from errors and offers greater flexibility. The Board of Directors should also ratify the membership action on this matter. The sixth step emphasizes the importance of keeping operating and reserve funds segregated. It is crucial not to commingle these accounts or engage in interfund borrowing. Any mixing of funds can negatively impact the safe filing of Form 1120. While the reserve portion of dues collected can be initially deposited into the operating account, it...

Award-winning PDF software

1120 (Schedule G) Form: What You Should Know

Schedule g OMB no. 1210‑0110 financial transaction schedules (form 5500) this chart provides fillable templates for 1120 Schedule G (Form 1120) — Internal Revenue Service — DOL. Schedule g OMB no. 1210‑0110 financial transaction schedules (form 5500) this form is filled out using IRS Form 1120. The 1120 Schedule G (Form 1120) — Internal Revenue Service — DOL. Schedule g OMB no. 1210‑1120 financial transaction schedules (form 5500) this form is used to fill out various 1120 Schedule G (Form 1120) — Internal Revenue Service — DOL. Schedule g OMB no. 1210‑1120 financial transaction schedules (form 5500) the financial transaction schedules from Form 5500. These 1120 Schedule G (Form 1120) — Internal Revenue Service — DOL. Schedule g OMB no. 1210‑1120 financial transaction schedules (form 5500) this form is used to fill out various 1120 Form 1120 Form OMB no. 1210‑0110 financial transaction schedules for a company's domestic or foreign branch. Form OMB no. 1210‑0110 is the form that is used by banks, brokerages, and investment 1120 Form 1120 Form OMB no. 1210‑1120 financial transaction schedules for a company's domestic or foreign branch. Form OMB no. 1210‑0110 is the form that is used by banks, brokerages, and investment 1120 Form 1120 Form OMB no. 1210‑0110 financial transaction schedules for a company's domestic or foreign branch. Form OMB no. 1210‑0110 is the form that is used by banks, brokerages, and investment 1120 Form 1120 Form OMB no. 1210‑1120 financial transaction schedules for a company's domestic or foreign branch. Form OMB no. 1210‑0110 is the form that is used by banks, brokerages, and investment 1120 Form 1120 Form OMB no. 1210‑1120 financial transaction schedules for a company's domestic or foreign branch. Form OMB no. 1210‑0110 is the form that is used by banks, brokerages, and investment 1120 Form 1120 Form OMB no.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120 (Schedule G), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120 (Schedule G) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120 (Schedule G) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120 (Schedule G) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120 (Schedule G)